Savings-debt debate update

I posted a few weeks back about how Mac and I have different visions on money. We’re trying to walk the fine line of the marital compromise and have come up with a solution. At the moment, Mac’s BAH (his housing allowance) and COLA (cost of living adjustment for technically being stationed in Qatar though he’s technically in Afghanistan) have not been added to his pay, so he’s actually making less than he should be. When those adjustments kick in, he should get a lump sum payment of what was not paid (basically the BAH for January and February all at once). We’ll move that to savings. Since we don’t have his exact pay (and I don’t feel like sharing that information), I’m not going to post the exact dollar breakdown. On an unrelated side note, how cool would it be if your savings account was a room full of gold coins a la Scrooge McDuck?

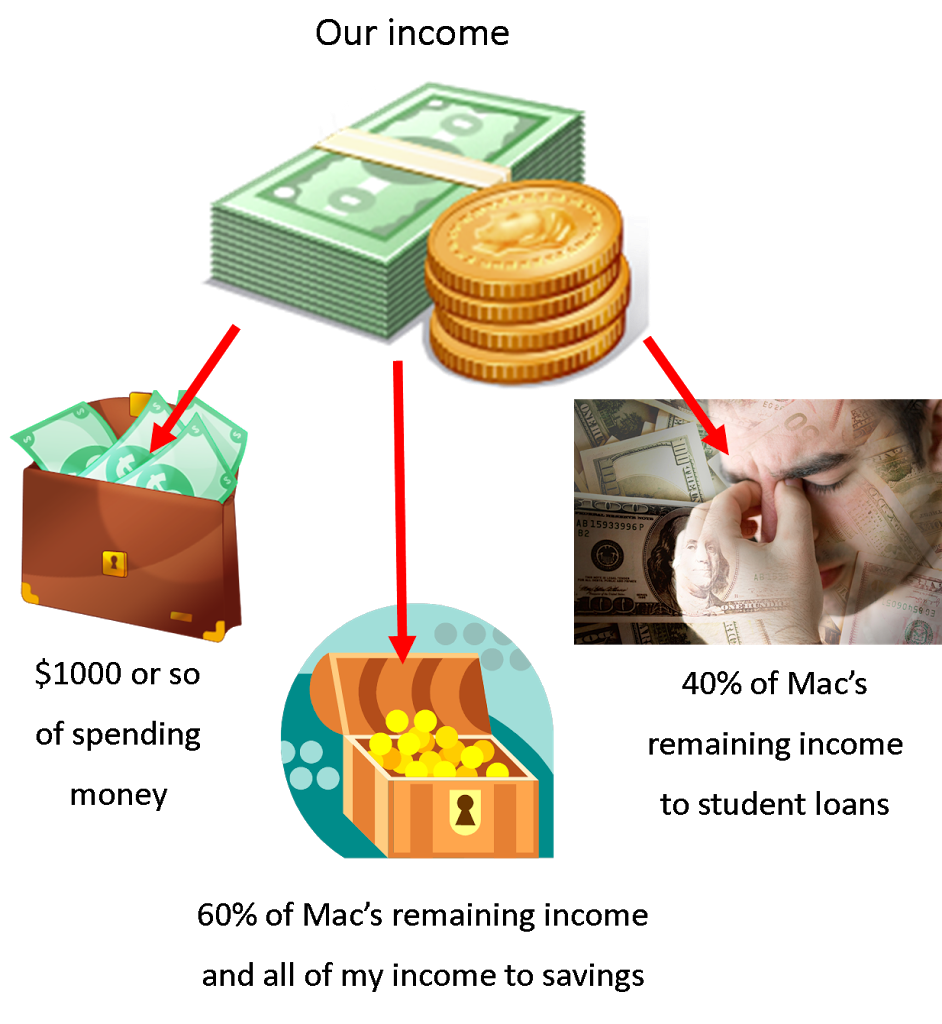

Our plan after payday:

1. Transfer all but $1000 out of our checking account.

2. Move all of my paycheck and about 60% of Mac’s paycheck to savings.

3. Put the remaining 40% of Mac’s paycheck towards my never-ending student loans.

Hopefully, we can stick to this plan and get our finances in good order this year.