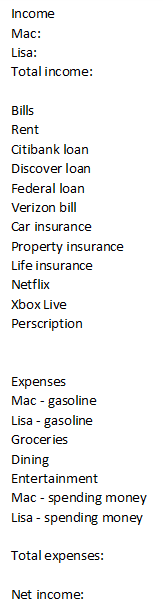

And my money on my mind. I finally bit the bullet and started working on a budget. First, I created an Excel spreadsheet: I listed our incomes at the top, our monthly bills, and monthly expenses. As I book classes and get paid, I’ll update how much I make. Excel has a bunch of great formulas and shortcuts; I utilized auto sum and subtraction. Bills are exact amounts, while expenses are estimates (what we do determines how much gas we use, etc). We also decided to give ourselves a monthly allowance for spending money in cash. We get this once a month for whatever we want and it’s gone once it’s gone.

I’m also a HUGE fan of Microsoft Publisher. It’s a good, basic design program that combines tools you can find in several other Office programs. I’m not a computer buff or design person, and it works really well for me. I made a monthly calendar that corresponds to each month’s budget. On it, I keyed in the due dates for every set bill (student loans, cell phones, credit cards). Depending on your personal preference, this would be really easy to do in your email or calendar provider and even set up reminders for due dates.

I plan to continually update the budget as we spend money, so we can get a good overall picture of our finances and spending. At the beginning of each month, I’ll adjust some of the expenses (like gas and groceries) based on our spending. The budgets and calendars will go in a page protector together and then in a newly-created finance binder.